🐶 Dog Treat Financing: Operant Conditioning meets UA Funding

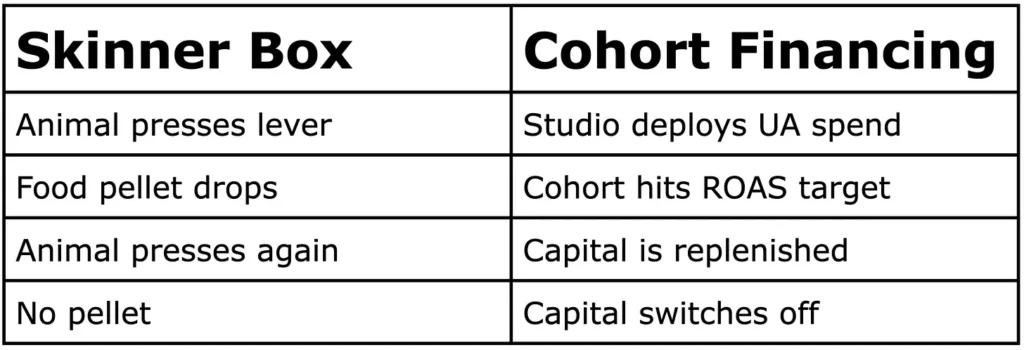

In B.F. Skinner’s operant conditioning experiments, an animal presses a lever and gets a food pellet. The behavior is reinforced, so it presses again. When pellets stop coming, the behavior naturally pauses. No punishment or negative consequence – just the absence of any reward. The system is self-correcting through immediate feedback.

Cohort financing for mobile UA works pretty much the same way. There are a lot of parallels in the approach which can be drawn, and when properly understood it can be a fundamentally better way to structure lending capital intended for user acquisition.

Deploy UA spend into a cohort. If that cohort hits its ROAS benchmark within the agreed timeframe, capital is released to fund the next cohort. Hit your targets again, unlock more capital again. The loop continues as long as performance continues, subject to an overall value-at-risk level decided by the lender.

But when a cohort misses its target – eg when D14, D30 or D90 ROAS falls below the reference cohort benchmark – the capital tap turns off. Not as punishment, not because the lender has lost faith. Simply because the lever presses stopped producing pellets. The behavior naturally pauses until the underlying performance issue is fixed.

This is fundamentally different from traditional financing. In a more conventional private credit facility, you may get all the capital upfront based on projections. Monitoring happens through monthly reports and quarterly covenant checks – backward-looking snapshots that tell you what already happened, not what’s happening right now. By the time everyone realizes (admits?) the unit economics have deteriorated, you may have already burned through months of capital.

Cohort financing eliminates this lag. The feedback loop is frequent and automatic. Hit the benchmark, get the capital. Miss the benchmark, capital pauses. The mechanism makes the decision automatically based on performance data and an agreed benchmark.

Why Traditional Structures Fail This Test

Traditional debt facilities create a dangerous structural problem: they can give you the ability to keep spending even when you shouldn’t.

Yes, prudent teams will scale back when performance deteriorates. But here’s the issue: with a traditional facility, the capital is normally committed and available. Even when the performance marketer knows cohorts are underperforming, there’s organizational pressure, momentum and quarterly targets to hit. The CFO sees unused capacity on the credit line. The exec team believes next month will be better. The capital is right there, so the temptation is always to deploy it while you “work through the issues.”

I’ve watched this play out dozens of times. A studio scales UA based on strong early cohorts. Then something shifts – creative fatigue, audience saturation, a competitor launch. D30 ROAS drops from 90% to 60%. With more traditional financing, the facility stays open. Maybe it’s seasonal. Maybe the next creative batch will perform better. Three months later, you’ve burned $5 million into cohorts that will never pay back.

The misalignment gets worse when studio and lender perspectives diverge. The studio wants to spend through the rough patch. The lender grows nervous but lacks any real-time mechanism to pause deployment without triggering a default or restructuring. Result: bad money chasing bad UA, finger-pointing, trust erosion, and eventual facility termination.

Cohort financing eliminates this structural flaw. There is no gap between performance deterioration and capital response. When cohorts miss benchmarks, the lever stops producing pellets. Behavior pauses automatically. You can’t keep spending even if you want to – the capital simply isn’t there until performance recovers.

The Guardrails ARE the Feature

This is what most people misunderstand: the “capital switches off” mechanism isn’t a constraint on flexibility. It’s protective infrastructure that creates better outcomes for both parties.

For studios, cohort financing prevents the catastrophic mistake of scaling into broken unit economics. When ROAS drops below the benchmark target, capital stops flowing immediately (ok probably with a little wiggle room at lender’s discretion). You can’t press the lever harder and make pellets appear. The mechanism forces you to stop, diagnose what broke, and fix it before you can scale again. Fix the creative, find new audiences, adjust bidding strategy. Only when performance recovers does capital return.

This is really more protective that it is restrictive. It enforces operational discipline at exactly the moment discipline matters most and is good for both parties.

For lenders, the protection is equally valuable. Traditional lenders face impossible judgment calls when portfolio companies underperform: cut them off and potentially kill a viable business, or keep funding and risk heavy losses? Cohort financing removes this subjectivity. Performance data makes the decision. Capital preservation happens through the structure itself, not through contentious negotiations.

But here’s the deeper benefit: these guardrails create continuous incentive for operational excellence. When capital availability is directly tied to cohort performance, studios stay intensely focused on the levers that matter – improving ad creative to lower acquisition costs, enhancing product features to boost retention, optimizing onboarding to improve early engagement. Every improvement in ROAS or LTV directly unlocks more capital. The financing structure rewards the exact behaviors that make businesses successful.

At any given moment, both parties want exactly the same thing. When cohorts hit targets, everyone wants to scale. When cohorts miss, everyone wants to pause and fix the problem. Perfect alignment, without antagonism or misaligned incentives. The financing structure reinforces good behavior and naturally prevents bad behavior.

How Good Operators Already Think

If you’ve run performance marketing at scale, this model should feel obvious. No competent marketer blindly scales a campaign to hit a quarterly budget regardless of performance. That would be insane.

Instead, they respond to signals in real-time: Day 1-7 ROAS looks strong at 50%? Increase budget, expand testing. Day 14 ROAS deteriorates to 60%? Pause immediately, investigate. Creative fatigue? Audience saturation? Competitor launch? Fix it, then resume when performance recovers.

This is operant conditioning at individual cohort/campaign level. Reward what works, pause what doesn’t. Every performance marketer operates this way because it’s the only rational approach for deploying capital into measurable, real-time systems.

Cohort financing extends this discipline from the campaign layer to the capital structure layer. Instead of the marketer deciding whether to scale based on ROAS, the financing mechanism decides whether to release capital based on cohort ROAS. The logic is identical – just one level up.

When capital availability mirrors performance quality, you get rational behavior at every level. The CFO can’t override the marketer’s judgment by “making more capital available.” If cohorts aren’t performing, the capital isn’t there. Finance and marketing are automatically aligned because they respond to the same performance signal.

The best studios already treat capital as a variable input that responds to performance, not a fixed budget allocation. They know capital is earned through results, not promised based on projections. Cohort financing makes this operational discipline explicit in the capital structure itself.

Reinforcement-Driven Capital

Call it dog treat financing if you want – the label is intended to playful, maybe even slightly ridiculous. But the underlying principle is serious: reinforcement-driven capital allocation.

Reward the actions that produce value. Pause the actions that don’t. Let performance data make the decisions, not projections or quarterly negotiations.

It’s almost absurdly simple – which is exactly why it works. Skinner figured this out in the 1930s. Press lever, get pellet, press again. No pellet, stop pressing. The system self-regulates through immediate feedback.

Ninety years later, we’re applying the same logic to how capital flows into user acquisition. Deploy spend, hit ROAS, unlock more capital. Miss ROAS, capital pauses, fix the problem, resume when performance recovers.

The elegance isn’t in the sophistication, but in the alignment. When the financing structure mirrors how good operators already manage their businesses, everyone wins. Or at least, everyone stops losing at the same time.

And in an industry that’s historically been very good at spending other people’s money while telling compelling stories about future performance, that might be the most valuable innovation of all.

Footnote: Of course anyone who is familiar with the original experiment would know that rats and pigeons were involved, not dogs – but it makes for a better analogy – and header image 🐾

Mobile Finance Collective is a pioneering community which brings together finance leads and founders of mobile app and gaming studios to share knowledge and build connections. We are supported by top tier industry mentors, and provide an environment where we can all learn from each other, helping to grow your business and enhance your career.