A Clean-Room Accounting Framework for UA and Monetization in Mobile Gaming

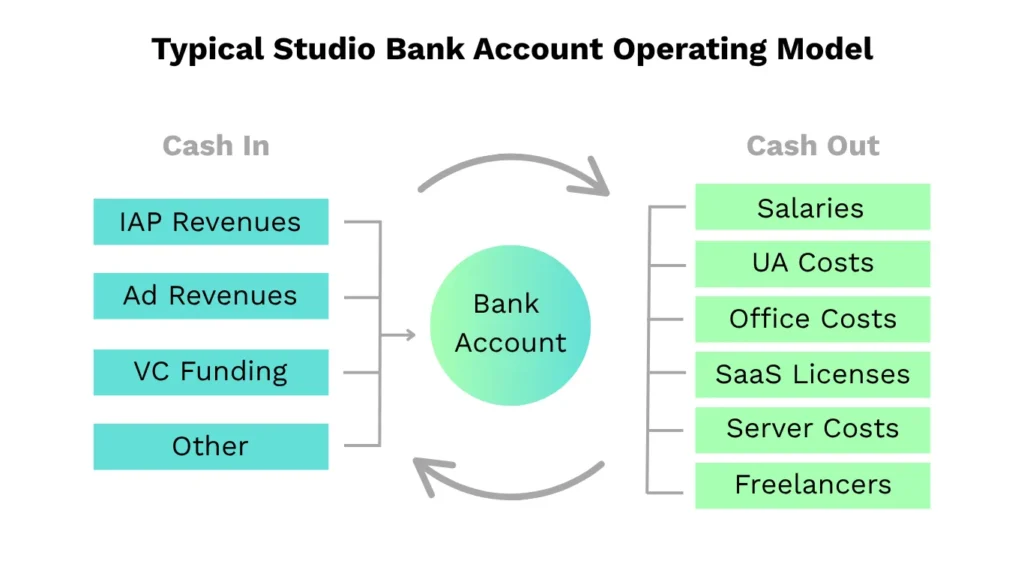

In every mobile gaming and app businesses, user acquisition and monetization are the engine room of growth. But they’re also where financial discipline tends to blur. In many companies, revenues, ad spend, salaries, and server costs often flow through the same account, leaving founders and their finance teams guessing about what’s really driving returns.

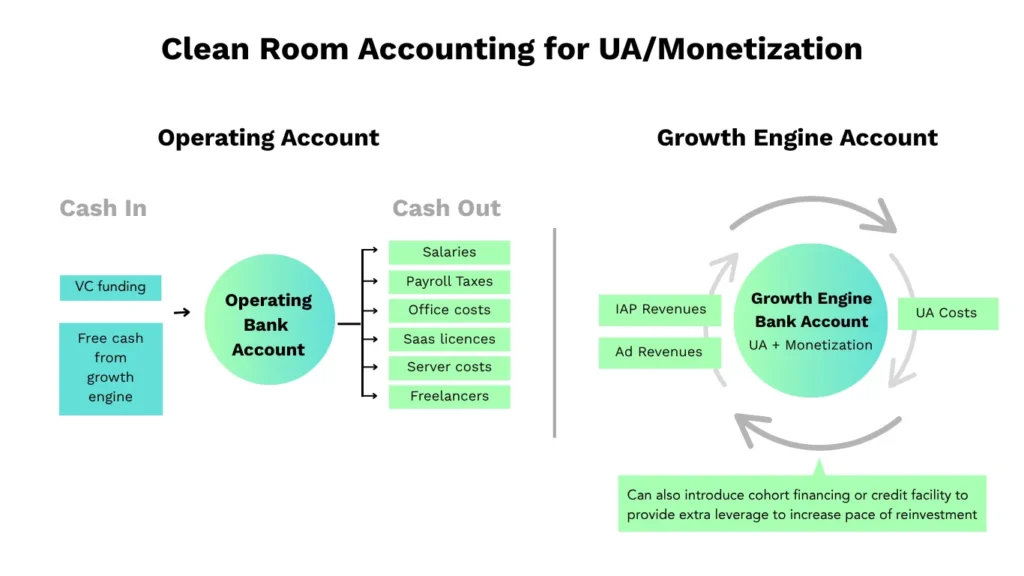

The concept of clean-room accounting is a simple operational framework that brings clarity and control to the financial engine of your business. The idea is to treat your user acquisition and monetization loop as a self-contained system — with its own inflows, outflows, and reporting — isolated from general operating expenses.

It’s not an accounting gimmick, but think of it more as a financial discipline where you run your business like an investment fund, where each dollar deployed can be measured for its return. Understandably when companies start and new projects kick off, this issue is trivial when compared to all other priorities within the business. But it’s good discipline to have it on the roadmap as it can be like Frankenstein’s monster to fix down the line.

The Core Idea

At its simplest, clean-room accounting means:

- All monetization revenue (IAP, ads, subscriptions, etc.) flows into one dedicated account.

- All user acquisition spend flows out of that same account.

- Studio operating costs (salaries, servers, overheads) remain separate.

You now have a closed loop – a “growth engine” that converts ad spend into cash flow. If you have multiple games/apps, you should operate a separate growth account for each entity. If there are operational challenges such as an ad network being unable to make game level payouts, then simple allocate the cash into the different game-level accounts as soon as the payments land.

Once you can see the machine clearly, you can optimize it, scale it and finance it with greater clarity. When profitable and creating excess cashflows, these can be transferred back into operating capital – think of it like an investment portfolio paying regular dividends back to its investors.

Why It Works

1. Clarity of returns

By separating UA and monetization from everything else, you can calculate true returns on investment. You know exactly how much capital you’ve deployed, how long it takes to come back, and how much it yields. There’s no noise from payroll or overheads to distort the signal. If you like you can track a running yield of the growth machine – a bit like a portfolio manager will monitor overall performance of their assets.

2. Better decision-making

Clean-room accounting enables UA and finance teams to create a more measurable investment engine. Cutting out the noise of other operating costs gives finance teams better clarity and the ability to more easily use IRR as a metric, as all cashflows are in the same place. Everyone works from the same reality.

3. Operational discipline

Keeping the loop separate enforces spending discipline. If the balance is growing, the machine is self-funding and scalable. If it’s shrinking, you know you’re burning capital and need to adjust. You can’t hide inefficiency behind general operating cash flow.

4. Financing advantage

When you eventually use credit facilities or cohort financing to fund UA, lenders (and your board) will expect this level of clarity. Having a clean, standalone flow of funds makes it straightforward to model returns and demonstrate that borrowed capital is productive and generating a positive return.

How to Set It Up

- Open a dedicated bank (or EMI) accountLabel it clearly. eg “UA / Monetization Account – [Name of Game/App]”.

Route all monetization revenue (ad networks/app store revenues) into it and pay out all UA spend to the ad networks from this account. If you have raised external equity capital it makes more sense to keep this in a segregated account focused on operations and runway, and to separate the growth engine cash flows which have different cost of capital and returns profile.

- Segregate operating costsKeep payroll, development, and general expenses in a separate “studio operations” account.

If you need to move money across, treat it as a formal transfer or dividend, not a casual mix. Reflect this in your financial record keeping.

- Monitor the loopYour UA machine has one simple rule: what goes out should come back multiplied.

Track this via cohort metrics — ROAS, payback period, and lifetime value (LTV).

Maintain a simple dashboard showing balance over time: if the account consistently replenishes itself, your growth machine is healthy.

- Define your reinvestment logicDecide how much of the proceeds you’ll recycle into new UA and how much you’ll withdraw for operating costs or profit.

The clearer this policy, the easier it is to scale without losing control. If external capital is introduced to scale the UA, the cost vs return makes it much easier to track if everything is segregated.

- Report it separatelyEven if you consolidate at group level, report your game/app level UA/monetization loop as a discrete P&L.

Over time, this becomes the single most important lens on how efficiently your company converts capital into growth.

A CFO’s Lens

Clean-room accounting reframes and gives clarity on how finance and growth teams interact.

For finance leaders, it provides audit-ready clarity, eliminates blurred cash flows, and simplifies forecasting. For founders, it offers the control and confidence to make UA investments without risking the rest of the business.

It also enables more intelligent capital allocation. You can decide whether to reinvest, pause, or leverage external funding with greater precision.

Common Mistakes to Avoid

- Mixing flows: If revenue or spend leaks into your general account, you lose the clarity that makes this model powerful.

- Ignoring time lags: App store payouts and ad-network settlements delay cash inflows; model those delays accurately.

- Treating the loop as static: Revisit your metrics regularly — LTV curves shift as creative, targeting, or economy changes.

- Right-sizing withdrawls: Pulling too much from the clean-room account to fund operations can starve the machine that fuels your growth.

Why It Matters

The most successful studios and app companies treat capital differently based on it’s expected risk/reward profile and not as a blur of spend. Clean-room accounting policies create the operating framework to do exactly that.

It aligns the finance team and the UA team around the same numbers, forces focus on efficiency, and provides the transparency that investors and lenders increasingly expect.

If you operate at any meaningful scale, you owe it to yourself and any potential future acquirer to make your UA and monetization loop as clean as your codebase.

Mobile Finance Collective is a pioneering community which brings together finance leads and founders of mobile app and gaming studios to share knowledge and build connections. We are supported by top tier industry mentors, and provide an environment where we can all learn from each other, helping to grow your business and enhance your career.