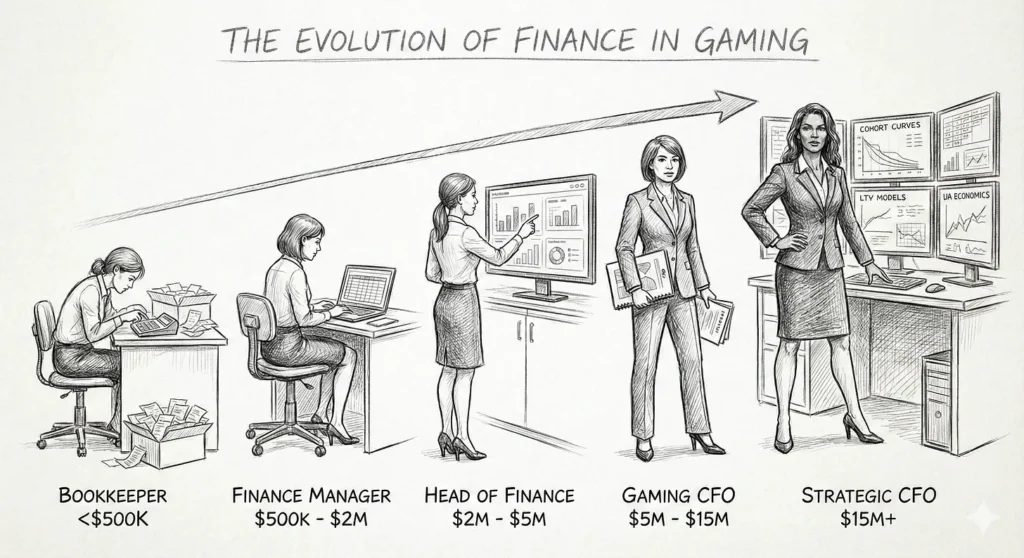

From Bookkeeper to Strategic CFO: The Evolution of Finance in Mobile Gaming

Many founders keep finance “good enough” for as long as possible. Spreadsheets, accountants, maybe a part-time CFO. But at some point, the business outgrows your skillset and decisions start to suffer.

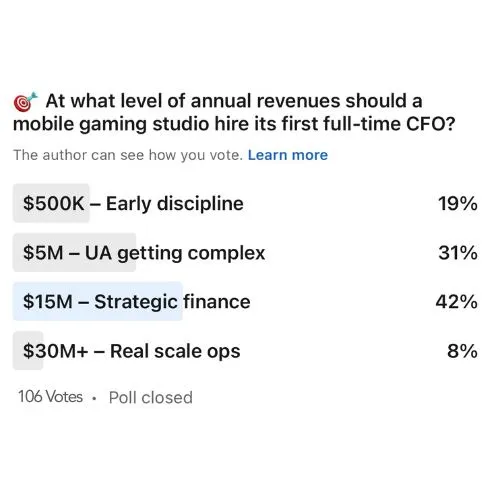

Recently, Mobile Finance Collective – the community of CFOs in mobile apps/gaming I founded in 2024, ran a LinkedIn poll asking: “At what level of annual revenues should a mobile gaming studio hire its first full-time CFO?” We received 106 responses, and the results clustered around $15M annually—the point where “strategic finance” becomes critical. But nearly a third voted for $5M when “UA is getting complex,” and others argued for earlier or later.

Here’s the thing: the answer isn’t really about a revenue number. It’s about complexity, stage, and what you actually need from a finance function. Before we can answer “when,” we need to answer “what.”

What Is a CFO, Really?

“CFO” has become a financial catch-all term that obscures what companies actually need. In practice, the title is super broad and covers an enormous spectrum:

Bookkeeper/Accounts: Processing invoices, reconciling accounts, recording transactions. Critical but mechanical.

Finance Manager/Controller: Monthly closes, management accounts, basic P&L reporting. Reactive, but brings discipline.

Head of Finance/FP&A: Forecasting, budgeting, board reporting, building financial models. Forward-looking and analytical.

Strategic CFO: Partner to the CEO on strategy, capital structure, M&A, organizational design. In gaming, fluent in UA unit economics and live ops monetization.

When founders say “we need a CFO,” they often mean different things: clean up our bookkeeping, proper investor reporting, help forecasting UA spend, or strategic partnership on capital allocation. These require different people with different skill sets at different price points. The first step is asking “what do we actually need our finance function to do right now—and six months from now?”

The Evolution: What You Need at Each Stage

<$500K annually: Bookkeeper plus external accountant. Founder remains de facto CFO. Don’t waste capital on finance infrastructure yet.

$500K-$2M: Part-time finance manager for monthly close and clean management accounts. Brings operational discipline, frees founder from admin.

$2M-$5M (The First Critical Juncture): Full-time Head of Finance, or part-time strategic CFO plus finance manager. VC-backed companies typically need more here – the investor reporting requirements alone can justify it. External IP deals with royalty obligations increase complexity significantly.

$5M-$15M (The UA Complexity Inflection): Gaming-specific finance expertise becomes essential. This is where traditional CFOs from other sectors struggle. You need someone who understands the significance of Day 7 retention, can model cohort economics, blended ROAS optimization, and how to forecast when 60% of revenue comes from ad monetization with a huge variance in user behavior.

$15M+: Full CFO suite. Strategic CFO plus controller/Head of Finance, potentially dedicated FP&A. Finance becomes a strategic enabler, not just a reporting function.

Key triggers that accelerate the need: Raised institutional funding, external IP deals, significant UA scale-up, international expansion, or M&A conversations.

Part-Time vs Full-Time

Hire a full-time CFO too early and they’ll be bored in days, producing beautiful models for scenarios that don’t matter yet. Wait too long and you’re asking someone to join a company making $5M/month with zero structure and a digital shoebox of receipts. How do you get it right?

The optimal hybrid scenario I often see working well: an experienced CFO operating a few days per month at a strategic level, paired with a full-time Head of Finance handling day-to-day operations. This gives you strategic horsepower without paying for full-time CFO availability you don’t need, while providing mentorship for your finance lead. Studios run this model successfully well into $20M+ range.

The fractional CFO option: Experienced operators who’ve left big gaming companies now work with multiple earlier-stage studios in fractional capacities. This can be powerful for the $2M-$10M range—someone who’s seen the movie before, can set up your finance function properly, and operates strategically a few days per week. It’s SUPER IMPORTANT to hire someone that understands the space, particularly around UA – so spend time looking for someone who can hit the ground running to avoid expensive disappointment!

Remote hiring: If you’re willing to hire remotely, your talent pool increases exponentially. The caveat: ensure specialist local knowledge for your jurisdiction. Cohort economics and UA forecasting are global, but statutory obligations are distinctly local.

User Acquisition: Where Generic Finance Hits a Wall

Let me be direct: this is where most CFOs from outside gaming struggle. UA finance in mobile gaming is genuinely different. The mental models don’t transfer, the math is different, and the pace is relentless.

Traditional CFOs think: we spent X on marketing, generated Y in revenue, here’s our CAC payback. Gaming CFOs think: Day 0-365 cohort curves, blended ROAS across multiple channels, LTV projections with confidence intervals, and how yesterday’s product update shifted Day 7 retention by 2%, meaning three-month-old cohorts will perform differently than modeled.

Here’s a common scenario: you’re spending $750K/month on UA, debating increasing to $1.2M. To answer this properly, you need to understand which channels are genuinely performing, model how increased spend affects blended ROAS beyond your efficient frontier, account for ad monetization revenue affected by seasonal eCPM fluctuations you can’t control, and stress-test scenarios where cohorts underperform LTV assumptions by 10-30%.

A traditional CFO can build a model. An experienced gaming CFO understands which assumptions are fragile and can articulate trade-offs clearly enough for informed decisions.

The loneliness of the role: You’re often the only person who deeply understands the financial dynamics. Everyone looks to you for answers – CEO on UA spend, product team on monetization drivers, board on forecast confidence. If you haven’t done this before, it’s a steep learning curve with high stakes. This is why having a peer network in gaming finance is so valuable. Think pattern recognition from others who’ve seen similar situations, calibration on whether your thinking is sound, and just being able to discuss challenges with people who understand.

When you need gaming-specific expertise: If UA spend exceeds $100K/month and is growing, you need someone with gaming experience or who can learn extremely quickly. What doesn’t work: assuming general finance competence will suffice and your CFO will “figure it out.” You’ll make expensive mistakes during that learning curve.

Practical Guidance

For Founders:

Start by auditing your current capability honestly. Do you have clean books? Reliable reporting? Forward visibility? Strategic insight? Map gaps to what you actually need—not titles, but specific problems to solve.

Red flags you’ve outgrown your setup: board meetings are stressful because you’re scrambling for materials, you’re making gut-feel UA decisions, month-end close takes two weeks, you can’t answer basic questions about payback by channel, or your finance person is drowning with no time for analysis.

Match capability to need: Ignore titles. Someone who was Head of Finance at a $50M gaming studio might be more valuable than a CFO from a $3M SaaS startup. Look for people who’ve operated one stage ahead of where you are now and have seen your future challenges.

For Finance Professionals:

Mobile gaming finance particularly when modeling UA, cohort economics and monetization is genuinely different from other sectors. The expertise is highly valued but requires investment to learn. Your peer network is your competitive advantage. Show your work, not just titles – such as cohort models you’ve built, forecasting frameworks you’ve implemented, decisions you’ve influenced. This is how you establish credibility with potential employers.

Conclusion

The question “when should we hire a CFO?” is asking the wrong question. The right questions are: What does our finance function need to deliver? What capability gap are we trying to fill? What’s the most efficient way to get that capability?

Revenue milestones are proxies for complexity. A studio hitting $15M with simple, organic growth has different needs from one hitting $5M with aggressive multi-channel UA and complex licensing. Map your needs to capability required, not arbitrary thresholds.

Done well, finance becomes a genuine enabler of better decision-making—visibility on whether you can afford increased UA spend, understanding which features drive monetization, stress-testing assumptions so you’re not blindsided, giving your board confidence you’re running a tight ship.

Get the right finance capability at the right time—not too early, not too late, at the right level of seniority and time commitment—and your finance function becomes a competitive advantage. Get it wrong, and you’re flying blind at exactly the moment you need clarity most.

Understanding what works across dozens of studios—what models people use, how they approach forecasting, how they structure teams, what mistakes they’ve learned from—provides pattern recognition you can’t get in isolation. Whether you’re a founder figuring out what you need or a finance professional building your career in gaming, being part of that community makes an enormous difference.

Mobile Finance Collective is a pioneering community which brings together finance leads and founders of mobile app and gaming studios to share knowledge and build connections. We are supported by top tier industry mentors, and provide an environment where we can all learn from each other, helping to grow your business and enhance your career.