Blog

Blog

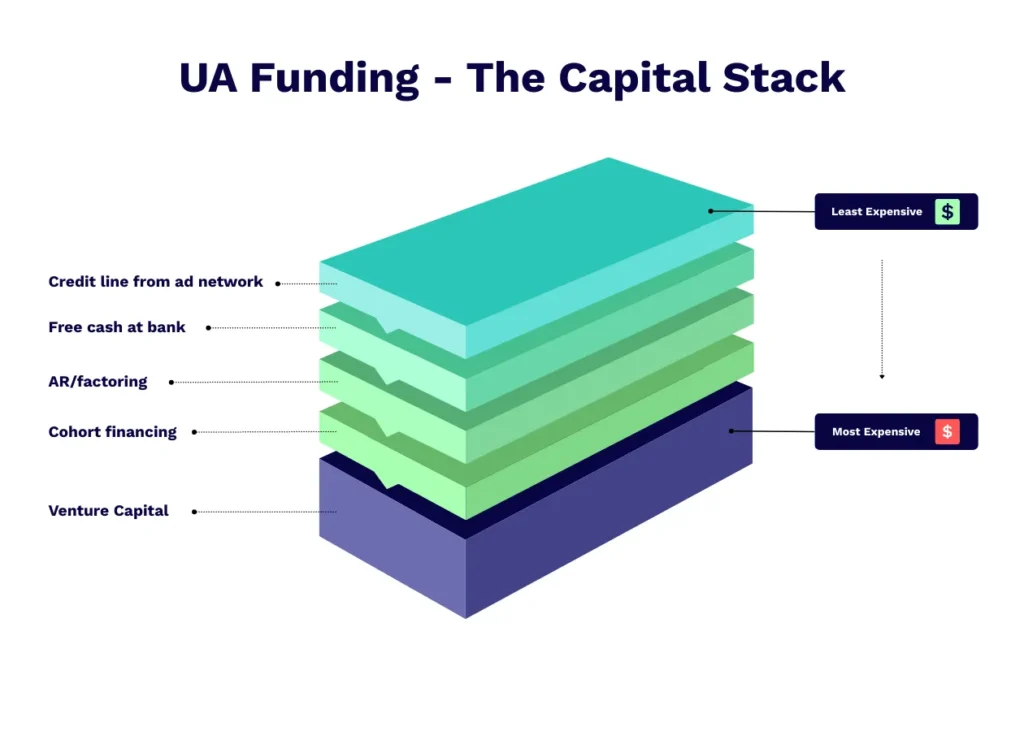

The Capital Stack

Martin Macmillan

CEO and Founder, Pollen VCWelcome the Capital Stack! A decade after founding Pollen VC and having lent hundreds of millions of dollars into the sector, I’ve seen the same question surface again and again across mobile gaming and app studios:

“If our UA machine is working — where can we find the capital to keep scaling it?”

If you’ve been lucky enough to crack the formula for profitable, scalable user acquisition — consistently turning paid ad spend into positive ROI — the challenge shifts from marketing performance to capital allocation strategy. And yet, too many studios still treat funding their UA emotionally, not commercially.

UA budgets are all too often set arbitrarily by finance teams trying to stick to a plan. Growth is often throttled by internal cash constraints. Too often UA managers are told what they can spend rather than asked how much they should spend based on real returns.

But if you’re reliably generating a positive return on every $1 invested in user acquisition, this isn’t a marketing problem — it’s a capital allocation problem.

The real question for UA teams is never: “What is my budget to spend this month?”

It is: “If my UA machine is working, what’s the smartest, most efficient way to continue to fund my ad spend without giving away more of the company than I need to in the process?”

To answer that, finance teams and founders need to think collaboratively and more like investors. That means understanding the concept of capital efficiency – using the lowest-cost and best fit funding product available to drive scale and mapping out your own Capital Stack: your available range of funding options, ranked by cost and risk.

In this post, we’ll walk through the modern UA funding stack and how the most sophisticated teams approach it methodically, as part of a capital allocation strategy – from the top of the stack working downwards, from lowest cost to highest cost.

1. Credit line from ad networks

All of the major ad platforms (Meta, Google, Applovin etc) offer credit lines to advertisers once they’ve established a track record of consistent spend and timely payments. Rather than requiring you to prepay for media or auto-charge a credit card daily, they extend net payment terms (typically Net30), effectively financing your ad spend for free during that window (around 45 days).

At first glance, this might look like the best form of UA funding — it’s free, flexible, and aligned with your media buying. But it’s not without caveats.

The key issue is timing — particularly the mismatch between:

- When you must pay the invoice due to the ad platform, and

- When your UA investment becomes ROAS positive

If your ROAS breakeven takes 90, 120, or even 180 days, and your invoice is due 30 days from the end of the month, you’re still left with a funding gap — even if you’re technically profitable. And that’s where many studios trip up.

At the same time, your inflows from app store or ad network revenue are often on a different cadence entirely (e.g. Apple pays out up to ~45 days after the end of the month), making cashflow forecasting and payment discipline essential.

✅ Pros

- No cost: There’s no interest or fees for using these credit lines — it’s essentially a short-term LTV risk transfer from you to the platform.

- In-product: Credit lines are often seamlessly integrated into your ad account, making them frictionless to use (their whole intention for keeping you spending!).

- Cashflow flexibility: For very short ROAS payback cycles, you can eliminate the need for external financing entirely, especially if you have a netting agreement on UA spend for ad monetized games on the same channel (think hypercasual)

⚠️ Cons

- Build-up required: Credit lines are only granted after consistent spend and payment history, which can take time to establish and often misaligned with your growth ambitions.

- Payback mismatch: If your ROAS breakeven is longer than the billing cycle, you’re still exposed to a funding gap and have to figure out how you’re going to fund it.

- Strict payment schedules: Invoices must be paid on time — missed payments can result in immediate credit suspension or revocation.

- Limited scalability: Your credit limit may plateau before your growth does and hard to extend given a tricky relationship between sales and credit teams at most ad platforms

💡 Bottom Line:

Credit lines from ad networks should be fully utilized where available — but only as part of a broader capital mix. Finance teams need to build detailed models that factor in not just UA performance, but also payment terms, breakeven timelines, and cash inflow schedules from app stores and monetization partners.

2. Free Cash Flow (and Cash at Bank)

When studios think about using “cash” to fund UA, they often treat all cash in the bank as interchangeable. But there’s a key distinction that must be made:

- Free Cash Flow: Net cash generated from profitable, revenue-generating operations — typically from a hit game or app with positive unit economics.

- Cash at Bank: The total cash balance, which may also include funds recently raised via equity financing, much of which could be earmarked for product development, hiring, or strategic initiatives.

Only truly free cash flow sits at the top of the Capital Stack. Everything else has strings attached. It all comes down to cost vs return on capital. If my funds in the bank are earning 3% on deposit per year, and my UA “machine” is giving me an annualised yield of 50% over the same time horizon, it makes total sense to invest your own excess cash before considering external alternatives.

Using operational cashflow to fund UA can be extremely efficient. But using VC cash that was allocated for product investment to plug a UA funding gap? That’s a different story and potentially a dangerous one.

✅ Pros

- Ultra-low cost: Your own profits reinvested. There’s no dilution, no interest, and no repayment.

- Fast deployment: No need for approval, term sheets, or underwriting.

- Clear ROI comparison: For example if you’re generating 2-3x returns from UA, that vastly outperforms the 3-4% annual yield you’d get leaving that cash in a bank account.

⚠️ Cons & Considerations

- Not all cash is “free”: If your cash balance includes a recent VC raise, it’s likely that a portion is earmarked (formally or informally) for product, hiring, or platform development. Diverting these funds can lead to both internal resourcing issues and investor concerns.

- Timing mismatches: If you use internal cash for UA, but your payback period is 180 days, make sure that doesn’t leave your operating team underfunded in 90. UA returns are great — but they’re not immediate. Careful cash planning by finance teams is essential here.

- Investor optics: Funders expect prudent capital management. Drawing down reserves too aggressively can give the impression of a studio running too close to the wire.

- Opportunity cost beyond interest: In some cases, holding more cash can be strategic, for example positioning for an opportunistic acquisition, giving you flexibility to weather seasonality, or extending runway in a choppy fundraising market.

💡 Bottom Line

Free cash flow from profitable games is gold — it should be the first port of call for funding scalable UA. But don’t assume all cash in your bank account is created equal. CFOs must segment their cash, align it with its original purpose, and model deployment based on payback timelines and cross-functional needs.

In short: treat cash like any other capital source — with a clear, disciplined allocation strategy that balances ROI, risk, and runway.

3. Factoring & AR-Based Credit Facilities

If you monetize through app stores or ad networks, you already know the pain: your revenue may be recognized today, but cash won’t hit your account for 30 to 60 days — sometimes longer. That lag ties up working capital that could otherwise be reinvested into UA.

Factoring and accounts receivable (AR) credit lines both offer solutions by unlocking the cash trapped in these delayed payouts. While they operate slightly differently, the goal is the same: convert predictable future income into usable capital today.

- Factoring typically involves selling individual receivables (e.g. an expected Apple payout) to a finance partner at a discount, in exchange for immediate cash.

- AR credit lines use your receivables as collateral for a revolving credit facility, allowing you to borrow against a pool of receivables up to a pre-agreed limit. Key here is the verification window – is the pool revalued every week (specialist lender) or every month (bank)?

In practice, the two models are very similar and both can be powerful tools for funding UA.

✅ Pros

- Capital-efficient: With typical costs of 1–2% per month, this is a low-cost, non-dilutive form of financing.

- Scales with growth: As revenue grows, so does your borrowing capacity.

- Flexible structure: Revolving nature means you can draw and repay in line with cash needs and spend cycles.

- Well-matched for fast ROAS: Particularly effective if your UA breakeven point is shorter (up to 90 days)

- Contained risk: Credit is secured against revenue already earned, so lenders and borrowers are aligned and risk of overextension is low.

⚠️ Cons & Considerations

- Not universal: Only applicable if your monetization runs through platforms with long payout cycles — e.g. Apple, Google, Meta. If you monetize on the web or via fast-pay platforms (e.g. Stripe, Paddle), there may not be enough delay to justify this model.

- Not great for longer ROAS periods. If your breakeven periods are longer than 90 days you may find that cohort financing is a better fit, subject to having enough performance data/

- Some setup required: Legal docs and verification processes can take time, but once live, these are generally smooth to operate.

- Facility limits apply: Typically lenders will offer 70–85% of eligible receivables, not 100%, and caps may apply depending on your volume and concentration risk.

💡 Bottom Line:

If you’re earning meaningful revenue from app stores or in-app ad networks, and have short(ish) ROAS breakevens, factoring or AR-based credit lines should be a core part of your capital stack. They let you reclaim control over your cashflow timing and fund profitable UA without dilution at relatively low cost.

Whether via specific invoice sales (factoring) or a pooled borrowing base (AR credit lines), these tools are especially valuable for studios with fast monetization cycles and short ROAS breakevens.

4. Cohort Financing

Cohort financing allows studios to borrow capital to fund new user acquisition, with repayment tied to the performance of specific user cohorts. Rather than borrowing against general revenues or assets, studios raise funds based on the projected return from the users they’re acquiring — often with a fixed fee and flexible repayment structure tied to future revenues.

It’s an increasingly popular model for mobile gaming and app businesses because it scales with performance, preserves equity, and closely mirrors the actual UA return profile — especially for companies with longer ROAS breakeven periods.

✅ Pros

- Aligned with performance: Repayment is typically a % of future revenue, so the obligation flexes with how your cohorts perform and returns are capped.

- Predictable cost of capital: Fixed-fee pricing means you know your total repayment obligation upfront — helpful for modeling returns.

- Ideal for longer payback cycles: Especially useful if your ROAS breakeven is 120 days or longer, where traditional credit options fall short.

- Enables potential additional leverage: If structured as a revenue share rather than traditional debt, it may not conflict with existing lender covenants — allowing for synthetic leverage on top of existing facilities.*

- Non-dilutive: No equity or ownership is given up.

⚠️ Cons & Considerations

- Cost sensitivity to payback speed: Because pricing is fixed, if your payback is faster, the effective IRR can be high. Always model both best and worst-case scenarios.

- Cashflow impact: If cohort revenue underperforms, even flexible repayment structures can put pressure on your operational runway — especially if other commitments exist.

- Can have aggressive monetization dynamics if reference cohort performance is not met – this can put an unplanned strain on operating runway

- Inter-creditor dynamics: If you already have senior debt in place, the structuring of a cohort facility needs careful legal review. Even if not legally classified as debt, overlapping claims on cashflows can create complexity.

💡 Bottom Line:

Cohort financing is one of the most powerful funding tools for UA when structured correctly. It’s especially well suited to longer payback periods and predictable LTV curves, giving UA teams more firepower without dilution.

But it’s not a shortcut — the flow of funds, repayment mechanics, and interaction with other financial obligations all need to be clearly understood. CFOs should treat cohort financing as a strategic layer in the capital stack, considering which instrument is best suited to their needs given both past investment into UA and also

*Always consult your existing loan agreements and legal counsel before attempting to layer on cohort-based financing alongside other debt instruments.

5. VC Funding

Venture capital has long been seen as the go-to source of startup funding — and for good reason. Equity is well-suited to funding risky, high-upside activities like building new IP, expanding teams, or developing new technology.

But when it comes to scaling a predictable, capital-efficient UA machine, equity is often the most expensive form of capital you can raise — and the least appropriate.

✅ Pros

- Strategic capital: A strong VC partner can bring more than money — access to networks, hiring help, BD introductions, and signaling value.

- No repayment: Equity carries no repayment schedule or interest burden, making it flexible for long-term, high-risk bets.

- Best fit for R&D and product: Ideal for building new games, entering new markets, or making big bets that don’t yet have a clear revenue path.

⚠️ Cons & Considerations

- High dilution: Typical early-stage rounds cost 20–30% of your company — making it a very expensive way to finance user acquisition.

- Wrong tool for the job: If you have a working UA engine with predictable ROAS, using equity to fund it is like using a sledgehammer to crack a nut.

- Fund mismatch: Many VCs raised large funds during the last cycle and now need to write bigger checks. But capital-intensive UA growth doesn’t scale to $500M+ fund outcomes easily — creating misalignment.

- VCs increasingly support non-dilutive capital: Today’s best VCs encourage portfolio companies to blend debt and equity especially for repeatable growth because it improves capital efficiency and fund IRRs.

- Signals poor capital planning: Raising equity purely to fund short-term, predictable UA spend suggests a lack of financial sophistication — and may raise questions from future investors.

💡 Bottom Line

Equity should be the last resort in your UA funding stack – not the first. If your ad spend is ROI-positive and repeatable, you should exhaust every non-dilutive option before considering equity.

There are absolutely good reasons to raise VC – to fund R&D, make strategic hires, or enter new markets. But using equity to bridge a 90- or 180-day ROAS gap is a red flag.

Smart CFOs and founders now treat equity as one part of a balanced capital strategy, often pairing it with cohort financing or credit lines to preserve ownership and improve capital efficiency.

📝 A Note on Private Credit & Structured Facilities

As studios scale and capital needs become more complex, the funding landscape expands beyond the core instruments covered above. Larger and more sophisticated companies — especially those with multiple revenue-generating titles or active M&A strategies — may benefit from more structured private credit facilities tailored to their broader financial profile.

This can include:

- Cross-collateralizing receivables and cohort residuals from a portfolio of games or apps

- Providing capital for leveraged buyouts of other publishers

- Structuring multi-tranche facilities with performance-based drawdowns

Private credit funds — some of which are now entering the mobile ecosystem, often alongside or in competition with PE sponsors — are increasingly active in originating and structuring these bespoke deals. But doing so effectively requires a deep understanding of UA economics, live ops cashflows, and platform dynamics — not just financial engineering.

We’ll explore these more complex capital structures in a future edition of The Capital Stack.

🧮 Summary

In today’s environment, CFOs, founders, and even UA managers are ultimately capital allocators. Their job isn’t just to manage a budget, but to evaluate where capital should go, and what form it should take, to create the most value.

Gone are the days when the only option was to raise equity and hope it stretched far enough. Studios now have access to a growing menu of financial products from smart use of ad platform credit lines to cohort-based financing and more sophisticated structured debt — all designed to match different risk profiles, cashflow dynamics, and growth strategies.

The job now is to understand:

- How each financing product works

- Where it sits in the Capital Stack

- What flexibility or restrictions it brings

- And how it interacts with your broader financial strategy

This isn’t just about choosing the cheapest capital. It’s about choosing the right capital that best matches your growth machine, your timelines, and your appetite for dilution or leverage.

The best studios don’t just build great games or apps. They deploy capital in a smart way that compounds value over time.

Mobile Finance Collective is a pioneering community which brings together finance leads and founders of mobile app and gaming studios to share knowledge and build connections. We are supported by top tier industry mentors, and provide an environment where we can all learn from each other, helping to grow your business and enhance your career.