Why aren’t you spending more on UA?

There’s a deceptively simple question I ask teams who want to scale their user acquisition:

“Why aren’t you spending more on UA?”

It sounds blunt—maybe even dumb. But over ten years working with CFOs, founders, and UA teams, this single question has consistently exposed the real bottleneck: either performance (you can’t profitably buy users) or finance (you can, but your capital structure won’t let you).

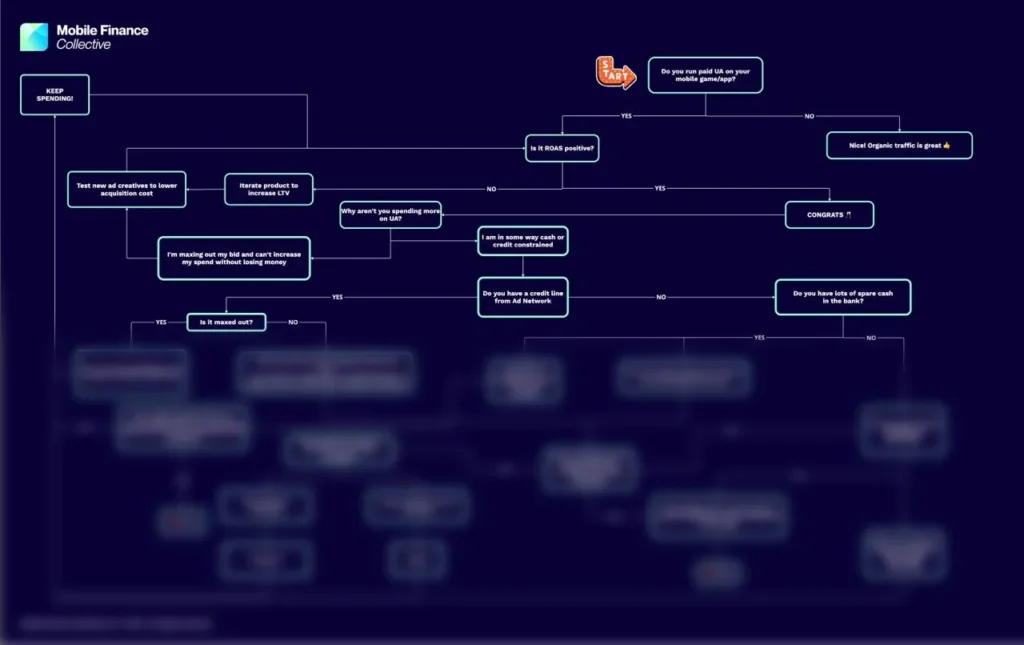

To make this actionable, I built a flowchart that maps the decision process from first principles. Think of it as a blueprint for how high-performing teams run UA: diagnose, decide, finance, repeat.

If you’d like the full flowchart, reply or comment and I’ll send it over else you can download it here.

The decision tree at a glance

1) Do you run paid UA on your app/game?

If no, there’s no conversation to be had about scaling paid spend. Enjoy the organic—genuinely!

If yes, proceed.

2) Is your UA ROAS-positive?

If no, stop attempting to scale. Fix the product and the funnel before you buy more traffic. Given that mobile UA is just demand economics at plan, you have two levers:

- Seek to lower acquisition cost (CPI/CAC) – eg test new ad creatives to reduce cost

- Iterate the product to increase LTV through improvements to conversion, retention, and payback.

If yes, great—now we move from performance to finance.

When performance is the problem (and what to do)

This is the most common reason teams stall: you simply can’t acquire profitably at today’s bids. Typical symptoms:

- “I’m maxing my bids but losing money.”

- “Costs are too high relative to LTV.”

- “Payback has slipped; cohorts aren’t breaking even.”

Actions that work:

- Creative volume & velocity. Push more creative concepts, faster. Kill losers ruthlessly.

- Onboarding & paywall. Diagnose first-session drop-offs and any paywall friction (for subscription apps).

- Pricing & packaging. Right-size trials, subscriptions, bundles.

- Retention levers. Notifications, loops, content cadence—small wins compound LTV.

Rule: Until you are comfortable that ROAS is demonstratively positive, don’t continue to plug in more dollars. Hope is not a strategy…

When finance is the problem (and how to fix it)

You’re ROAS-positive, but you’re cash or credit constrained. This is where many teams leave money on the table.

Step 1: Use built-in credit (then know when to stop)

Most ad platforms offer some form of credit line or monthly billing. Use it, but make sure you always model the cycle length and understand the impact on your overall financial position.

- If your ROAS breakeven (payback) is shorter than the credit cycle, great—you can revolve that credit safely (subject to payment terms of platforms – in some cases you may be able to net off UA and ad monetization on the same platform).

- If payback is longer than the credit cycle, you’ve got a mismatch: you can’t pay the bill when it’s due even though the cohort is good. This is when scaling stalls.

Step 2: Bridge the mismatch with external capital

When credit cycles are shorter than cohort payback, bring in non-dilutive capital to keep spending. The right tool depends on cohort duration:

- Short-duration cohorts (< ~120 days):

Consider AR credit lines / factoring against platform receivables. These work well when cash turns fast, and especially if you have a relatively convex LTV curve, ie your game/app sees early monetization quickly. - Long-duration cohorts (> ~180 days):

Consider Cohort Financing—funding sized to the cash flows of each UA cohort, paid back from the cohort’s returns over time. More expensive but there is a shared risk/reward paradigm in this instrument that is well suited to longer dated more risky investments.

Both allow you to keep compounding profitable spend without tapping precious reserve cash or selling equity.

Step 3: What if you have lots of cash?

Great—decide how much you’re truly willing to run to the wire. Many teams still prefer to keep a reserve for product risk, platform policy changes, or seasonality. If you want to keep that buffer and still scale, non-dilutive financing is your friend. Just always keep in mind the cost and return of capital of money sitting in the bank that could be earning a greater return, and right-size that cash buffer vs paying away spread to a lender.

Step 4: What if you want to continue scaling beyond non-dilutive limits?

If unit economics are proven and your ambition is to outrun the market, that’s the time to consider raising equity. Thankfully this happens less and less these days as founders better understand capital efficiency and the appetite of lenders and cohort financing has filled the void that used to turn founders back to their VC investors.

How to use this framework each week

- Run a UA x Finance standup:

15 minutes with Growth + Finance. One slide: ROAS by cohort window, payback curve, credit utilization, and cash forecast. - Track four numbers religiously:

- CPI/CAC by channel & creative

- LTV curve by cohort

- Payback – days to breakeven

- Credit cycle vs. cohort payback (mismatch = financing need)

- Choose the right capital for the job:

- Ad credit first, until the cycle mismatches payback

- AR/Factoring for cohorts with <120d payback

- Cohort Financing for cohorts with >180d payback

- Equity when you just have run out of options, but the unit economics still warrant it

- Have a “Stop” condition:

If ROAS turns negative or creative fatigue pushes CAC above LTV, pull back and fix performance before re-financing the loop. Decide upfront your margin tolerance – you may not want to run things right to the wire.

Common pitfalls (so you can avoid them)

- Trying to scale with negative unit economics. It’s not “investing”—it’s burning. Everyone can see through top line revenue growth. Nobody cares unless the cohorts are profitable.

- Underestimating credit-cycle risk. Net-30 bills from big ad networks don’t care that your payback is 150 days. You need to figure out how to pay your bills on time or you’ll be suspended.

- Treating all dollars as the same. Working-capital dollars and learning dollars are different tools.

- Running without a reserve. Volatility happens. Always keep some gas in the tank.

The takeaway

If you’re not spending more on UA, it’s almost always one of two things:

- Performance: Costs too high relative to LTV → Fix creatives, funnel, product, pricing, retention. The price set in the ad auctions just does not enable you to keep spending given your monetization profile.

- Finance: Profitable but constrained by cash/credit/cycles → Use the right non-dilutive tool for your cohort duration.

Get those two right, and the “dumb” question becomes your weekly spend decision ritual, and sets your guardrails for responsible management of UA spend. The intersection of finance teams and UA teams is essential here and both should invest time in understanding each other’s business

Want the full decision flowchart?

You can download the PDF here. If you’re evaluating financing options for your UA engine, I’m happy to walk through your numbers and help you map the best fit.

Mobile Finance Collective is a pioneering community which brings together finance leads and founders of mobile app and gaming studios to share knowledge and build connections. We are supported by top tier industry mentors, and provide an environment where we can all learn from each other, helping to grow your business and enhance your career.